Increase labour taxes, reduce capital taxes

Trabandt and Uhlig have a well-crafted new NBER working paper:

For benchmark parameters, we find that the US can increase tax revenues by 30% by raising labor taxes and 6% by raising capital income taxes. For the EU-14 we obtain 8% and 1%. Denmark and Sweden are on the wrong side of the Laffer curve for capital income taxation.

With predictable implications:

[...] lowering the capital income tax as well as raising the labor income tax results in higher tax revenue in both the US and the EU-14 (DC: EU-15 sans Lux), i.e. in terms of a “Laffer hill”, both the US and the EU-14 are on the wrong side of the peak with respect to their capital tax rates.

These results match my priors almost exactly, and I would think those of the mainstream economist too. This makes their model a good model. But I'm afraid they perfectly match the authors' priors too; this makes it a not so informative model.

I will now believe these numbers with ever-so-slightly increased certainty.

The Window Tax

1696-1851. The Pharaohs would not have approved.

1696-1851. The Pharaohs would not have approved.

Are the baby boomers coming?

This is, for example, Greg Mankiw: 'a looming fiscal crisis, which threatens to unfold as baby boomers retire and start collecting Social Security and Medicare' (and, unrelated to the topic, here's an entertaining quarrel)

This graph from the Congressional Budget Office flies to the face of this mantra: A presentation is here, and here's interesting commentary:

A presentation is here, and here's interesting commentary:

Although many observers portray aging as the dominant cause of future growth in federal spending on Medicare and Medicaid, most of the increase that CBO projects reflects rising costs per beneficiary rather than rising numbers of beneficiaries. The effect of population aging is smaller.

That said, note that this (i.e. Medicare and Medicaid commanding 20% of GDP), simply can't happen, and the only thing that can give is the 'excess cost'.

What this graph says one thing only: we should expect the growth rate of medical knowledge to slow down in the years to come.

Wesley Snipes gets three years

Hollywood actor Wesley Snipes has received a three year prison sentence for tax offences.

A federal judge handed down the maximum term requested by prosecutors - one year for each of Snipes' convictions of wilfully failing to file a tax return.

United States District Judge William Terrell Hodges said the action star had shown a "history of contempt over a period of time" for US tax laws.

"In my mind these are serious crimes, albeit misdemeanours", he said.

Snipes apologised, saying: "I am an idealistic, naive, passionate, truth-seeking, spiritually motivated artist, unschooled in the science of law and finance."

That's one of the best quotes I've heard in a long time. BBC News has the story.

How America banned marijuana

I'm watching Ron Mann's 1999 Grass, narrated by Woody Harrelson. Some of the propaganda films depicted are astonishing - did people really believe that stuff? I don't want to hear anyone ever say again that modern America is an immature society.

And here is something I didn't know - the artful way in which marijuana possession was made a federal crime:

The Marijuana Tax Act was signed into law by President Roosevelt in 1937. The act prohibited possession of marijuana anywhere in the United States without a special tax stamp from the Treasury Department, and the Treasury Department didn't give out any stamps, effectively making marijuana illegal.

Genius. It is also telling how that such an elaborate arrangement had to be dreamt up to achieve criminalisation of marijuana: the power to ban a product was a new-found one.

Bush, the debt, Mankiw and spin

An 'econonerd friend' of Greg Mankiw's in the White House emails him with this analysis. Greg posts it approvingly, and I am fuming. Yes, Senator Conrad's analysis is misleading, but he is a politician - I've long learned to not seek insightful economic analyses in public statements by that lot. Last time I checked, however, Greg Mankiw was still one of the brightest stars of the economics profession and higher standards apply.

Let the econonerd speak:

Yes, the federal debt is higher than when the President took office. Debt in 2001 = 35.1% of GDP. Projected debt in 2009 = 37.9% of GDP. [...] Measured as a share of the economy, it's about 8% higher than it was when the President took office. (37.9 - 35.1) / 35.1 = 8%

Debt as a % of GDP stood at 35.1 at the end of fiscal 2000. But, as Senator Conrad reminds us, the budget is presented by the president outgoing, so GW Bush did not inherit the debt at 35.1% of GDP: he inherited it at 33% of GDP, where it stood at the end of fiscal 2001. (37.9-33)/33 = 15%.

So how did G.W. do compared to his predecessors? I multiply 15% by 8/7 to estimate an overall effect of Bush on the debt, as well as double the number for Presidents who only served one term (so that I can compare like with like). 'Kennedy' covers both the Kennedy and Johnson presidencies, and 'Nixon' covers Ford's presidency too.

Here's the effect each administration had on public debt as percentage of GDP:

George W. is slightly better than his dad in terms of not-increasing-public-debt-by-very-much, and he shines compared to Reagan. Eisenhower and Nixon/Ford actually reduced debt as a % of GDP (albeit by less than the adjacent Kennedy/Johnson and Carter administrations respectively), while Bill Clinton can boast the largest reduction since at least Kennedy/Johnson.

So, historically speaking, W. Bush only performs 'well' compared to the worst performers, Reagan and his dad, both Republicans (note that all Democrat Presidents achieved significant reductions in debt as % of GDP during their terms)

And there's more:

[Chairman Conrad's presentation is misleading in that it includes] no comparison to the historic average - It's relevant to compare our federal debt [held by the public] with historic averages, to see if we're in a lot of debt relative to where we've been in the past.

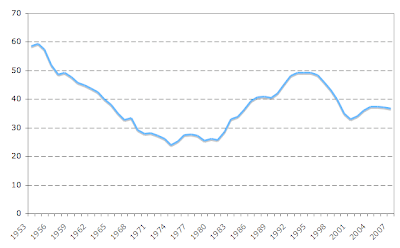

Here's the graph the 'econonerd' - (by this stage I believe a more accurate description would be econospinster') posts:

And here is the same series going further back:

'Debt is near the historic average'?!? The series goes all-over the place, so 'historic averages' are mostly driven by the time window chosen. Choose the number of years that suits you, and you can claim that current debt as a % percentage of GDP is higher/lower/equal to the long-run average (going back beyond 1953 makes this even more interesting). Why not calculate a historic average going back 30 years? (the decision to not go back further than 40 years probably has to do with the fact people would start thinking WWII). The econonerd also missed the killer point here: why not compare US Federal debt with Italian public debt? (do I have to do your work for you?)

Also, note that choosing to start your graph at 1991 creates a nice 'debt ain't that high' visual effect. (the first person to propose a plausible-sounding reason why 1991 should be the choice of a starting point for a 'debt under Bush' graph wins a White House 'economics' job).

And finally, a question for Bluematter. readers: Is "almost doubling" an inaccurate description of a 79% increase? This is not a trick question, looking forward to your views in the comments section.

Update: Andrew Samwick has another objection, via Angry Bear.

Greg Mankiw is up to no good

Greg Mankiw comments on why he is not interested in heading the NBER:

Why did I decide not to pursue the job? As in many such decisions in life, various factors were at play, both personal and professional. But what really pushed me over the edge was pending tax policy. With the Bush tax cuts set to expire in a couple years, I am looking for ways to reduce my taxable income.

He also quotes a paper by Martin Feldstein, the outgoing NBER head, which sheds light on what Greg intends to do:

A change in individuals' marginal income tax rates can induce them to alter their taxable income in a wide variety of ways, including:If my interpretation of Greg's statement is correct, the driving force behind his decision is not to increase the amount of leisure he consumes: he doesn't want to substitute some leisure for income, he is looking to reduce his taxable income. So 1 is out.

1. changes in labor supply,

2. in the form in which employee compensation is taken,

3. in portfolio investments,

4. in itemized deductions and other expenditures that reduce taxable income, and

5. in taxpayer compliance.

3 is also out, as it is not a labour market response and it is independent from his decision to take the NBER job. Four is largely independent of labour market decisions as well. This leaves us with 2 and 5, and 2 is in most cases nothing other than a soft version of 5.

So Greg's plan is to invest more resources in cheating the taxman, which is at best morally ambivalent and at worst outright illegal.

Furthermore, it is notesworthy how he takes this opportunity to make a political statement. He could have just said 'the NBER job does not pay enough'.

Progressive taxation: yeah, right

Alex Tabarrok and Greg Mankiw have the right answer to the wrong question. The question is whether the rich pay a higher share of their income in taxes than the poor, and the answer is yes*.

Do you remember Robin Hood? He stole from the rich and gave to the poor; there is no account of the story where he is described as stealing from the high-earners.

The progressivity of income tax is not the *issue* at all. What really matters for people's welfare and purchasing power is wealth. Looking at the tax system as a whole, the rich pay a scandalously small proportion of their wealth in taxes, the poor a scandalously large one. (let me remind you that in the US 1% of households owns 38% of all wealth on last count, and that's not including intangible wealth such as human capital and access to corporate assets.) And still we have this ridiculous situation whereby people try to figure out how redistributive our society is by looking at the flow of purchasing power and ignoring the bloody stock.

Now, Robin, this is status quo bias.

*these numbers are computed in a way that makes the gap in the effective tax rates between the poor and the rich appear wider than is actually the case, but that's an issue for a different post.

Disclaimer: As is usually the case, this is all positive analysis, and descriptive - rather than policy prescriptive - (couldn't help the rhyme here) at that. I'm not saying the rich should be paying more and I'm not saying that they shouldn't. I'm not saying we should be looking to tax wealth rather than income either. And if the words 'consumption' and 'savings' sprung to mind as somehow justifying it all, well done, but this is not a post about morality.

Madam Ruby's

From Pee Wee's Big Adventure.

The 2008 US Federal Budget

A fantastic visual guide to the US Federal Budget.

How to tackle the distortionary effect of taxation

Taxation generally has nasty side-effects, because when you tax something people tend to do/produce/buy less of it. These tax-induced changes in bahaviour not only lead to inefficiency, but they also cause the resulting tax yield to be lower compared to what it would have been with no change in behaviour. Modern governments tend to treat these tax-induced behavioural changes as fair-play, but the pioneers would apparently have none of it:

During the various reins of the Egyptian Pharaohs tax collectors were known as scribes. During one period the scribes imposed a tax on cooking oil. To insure that citizens were not avoiding the cooking oil tax scribes would audit households to insure that appropriate amounts of cooking oil were consumed and that citizens were not using leavings generated by other cooking processes as a substitute for the taxed oil.

From the not-very-reliable-looking Tax World website.