50 ways to leave your lover, recession edition

BEIJING (Reuters) - Fears of a prolonged recession in China have triggered a sharp increase in divorce inquiries addressed to lawyers and financial advisers, state media reported on Monday, with timing a key issue.

Wealthy spouses were keen to strike a deal while asset values were low, the China Daily quoted the director of the China Divorce Service Center, Shu Xin, as saying.

But China University of Political Science and Law professor Wu Changzhen said it may be too early to know the impact of the financial crisis on divorce rates.

"It seems the rates may have dropped since the downturn, because divorces are expensive," he was quoted as saying.

Friday Special 86

msnbc's take on the year 2008 in pictures

msnbc's take on the year 2008 in pictures

Testing your knowledge about the world on FreePoverty

A small but growing repository of Book Outlines

Australian repays £5 debt 39 years on

Best Road Trips in the world

Friday Special 85

Years it took to reach a market audience of 50 million: Radio 38 years, facebook 2 years

Years it took to reach a market audience of 50 million: Radio 38 years, facebook 2 years

German website on world interest rates, but still quite useful

MediaStorm innovating multimedia storytelling

Time's quote of the day

Friday Special 84

Kelley Ryden photography

Kelley Ryden photography

Another very good photo collection of pictures taken in North America

The $12 million stuffed shark

Amazon.co.uk's page for the paperback is here, and here's the hardcover

. The subtitle is 'The Curious Economics of Contemporary Art', and the book is a joy to read even if you don't have a few million dollars to spare and a large empty wall in your $15 million apartment. I know of no other popular book that offers such a good overview of the institutional framework and market structure of the contemporary art world, complete with authoritative lists of the top artists, works, collectors, dealers and galleries.

The economic argument of the book is admittedly not very deep (branding is important; get branded and you can sell anything at any price) and the inevitable frowning-down-on-people-paying-millions-to-put-garbage-in-their-living-rooms morality does creep into the text.

That said, the book is the best primer (and probably all you'll ever find useful or interesting to know) on contemporary art, and it is simply a fascinating read from cover to cover. Although it is strictly non-fiction, the $12 Million Stuffed Shark is gripping in a way more reminiscent of fiction; the colourful characters that come alive in its pages - the artists, buyers and dealers that create contemporary art - occupy a world of money, glamour and pop philosophy that is as interesting as anything that could be imagined.

Larry Gagosian [...] born in Los Angeles and seemingly known to everyone in the art world either as 'Larry Gaga'; or, due to his endless energy, as 'Go-go', [...] is to art dealing what George Steinbrenner was to baseball-team owning. He is famous for his silver hair, beautiful companions, and a very large home in East Hampton, New York called Toad Hall. He is one of the few dealers to get away with breaking the unwritten rule that you should not be seen to live better than your artists. [...]

With the exception of the late Jean-Michel Basquiat, the Brooklyn-born son of Haitian and Puerto Rican parents, a high school dropout with no formal art training, Gagosian has neither nurtured nor represented new artists. Basquiat made himself that exception, going to Los Angeles in 1983 where he talked his way into living and working for six months in one room of Gagosian's beach house in Venice. The great trivia aspect of that story is the identity of Basquiat's girlfriend, who lived with them; the then unknown singer Madonna.

Recommended.

The Economic Organisation of a POW Camp

After allowance has been made for abnormal circumstances, the social institutions, ideas and habits of groups in the outside world are to be found reflected in a Prisoner of War Camp. It is an unusual but a vital society.

One aspect of social oganization is to be found in economic activity, and this, along with other manifestations of a group existence, is to be found in any P.O.W. camp. [...]

Everyone receives a roughly equal share of essentials; it is by trade that individual preferences are given expression and comfort increased. All at some time, and most people regularly, make exchanges of one sort or another.

Although a P.O.W. camp provides a living example of a simple economy which might be used as an alternative to the Robinson Crusoe economy beloved by the textbooks, and its simplicity renders the demonstration of certain economic hypotheses both amusing and instructive, it is suggested that the principal significance is sociological. True, there is interest in observing the growth of economic institutions and customs in a brand new society, small and simple enough to prevent detail from obscuring the basic pattern and disequilibrium from obscuring the working of the system. But the essential interest lies in the universality and the spontaneity of this economic life; it came into existence not by conscious imitation but as a response to the immediate needs and circumstances. Any similarity between prison organization and outside oganization arises from similar stimuli evoking similar responses.

This is from the introduction to R.A. Radford's famous 1945 article in Economica - as beautiful a piece of scholarly work as you are likely to find, and a wonderful introduction to economics.

Friday Special 83

The soul of Italy captured in these magnificent pictures

The soul of Italy captured in these magnificent pictures

Random live web cams from all over the world

On the love for snow: Levitation Project

Inside a Ferrari Scuderia Spider 16M

The beauty of Distant Horizons

These dudes rock

Just watch this video and stop worrying about the youth of today. Well done guys!

If you believe in Ricardian equivalence, you don't believe in recessions

The same rational, non-credit constrained individual that will save a tax rebate in anticipation of higher taxes in the future is the same rational, non-credit constrained individual that will save something extra in the good times so he can maintain his consumption level unchanged during recessions - as much a certainty in life as death and taxes.

If you believe that fiscal stimuli are pointless, then you don't believe in recessions as we know them.

Friday Special 82

US ancestor statistics and more on Visualizing Economics

US ancestor statistics and more on Visualizing Economics

National Income accounting at times of war

The crucial question: does war spending purchase a final good and hence belong in GNP, or an intermediate good and hence not belong?

If you find this sentence even remotely interesting, click through and you won't be disappointed. Here's the abstract, complete with Von Mises quote:

Relying on standard measures of macroeconomic performance, historians and economists believe that “war prosperity” prevailed in the United States during World War II. This belief is ill-founded, because it does not recognize that the United States had a command economy during the war. From 1942 to 1946 some macroeconomic performance measures are statistically inaccurate; others are conceptually inappropriate. A better grounded interpretation is that during the war the economy was a huge arsenal in which the well-being of consumers deteriorated. After the war genuine prosperity returned for the first time since 1929. “War prosperity is like the prosperity that an earthquake or a plague brings.” —Ludwig von Mises

And here's another interesting paragraph (more planes than tanks?):

From mid-1940 to mid-1945 munitions makers produced 86,338 tanks; 297,000 airplanes; 17,400,000 rifles, carbines, and sidearms; 315,000 pieces of field artillery and mortars; 4,200,000 tons of artillery shells; 41,400,000,000 rounds of small arms ammunition; 64,500 landing vessels; 6,500 other navy ships; 5,400 cargo ships and transports; and vast amounts of other munitions. Despite countless administrative mistakes, frustrations, and turf battles, the command economy worked. But, as always, a command economy can be said to work only in the sense that it turns out what the authorities demand.

Tax incidence is a bitch, or labour is not a homogeneous factor of production

Model highly paid workers (CEO-types, bonus-driven investment bankers, highly skilled professionals, etc) as a different factor of production to not-so-highly paid workers (e.g. manual labour, inexperienced workers, etc).

In light of this information, discuss the following statement:

If we raise taxes on the highest paid workers, wages will adjust so that some of the burden falls on lower paid workers (as well as consumers, capital, etc, etc.)

Captured in a moment of Bluematter.

... explore the bluematter. journey

... explore the bluematter. journey

Friday Special 81

Beautiful Birdseye Pictures of London by Night

Beautiful Birdseye Pictures of London by Night

Volunteer abroad and gain a broader view of the world

Friday Special 80

Ferrari V4 motorcycle concept

Ferrari V4 motorcycle concept

More creative concept car designs

Job voyager visualizing employment distribution over the past century (fancy flash search)

Friday Special 79

More color pictures from the Great Depression

More color pictures from the Great Depression

The ultimate who-owns-who in the motor industry

The job

Final results: Obama elected President of the United States

You read it on Bluematter first.

Trade not aid, says coffee

Friday Special 78

Defining natural beauty from Natural Geographic

Defining natural beauty from Natural Geographic

Progress, South American style

Tornado forming during football game

The Window Tax

1696-1851. The Pharaohs would not have approved.

1696-1851. The Pharaohs would not have approved.

My kind of fun

Volkswagen’s shares more than doubled on Monday after Porsche moved to cement its control of Europe’s biggest carmaker and hedge funds, rushing to cover short positions, were forced to buy stock from a shrinking pool of shares in free float.

VW shares rose 147 per cent after Porsche unexpectedly disclosed that through the use of derivatives it had increased its stake in VW from 35 to 74.1 per cent, sparking outcry among investors, analysts and corporate governance experts.

Shares in VW closed up €309.15 at €520, giving it a market capitalisation of €153bn, more than all the other US and European carmakers put together.

The FT has the full story, hat tip MR.

Merv is surprised a hedge fund hadn't pulled this one over other hedge funds in the past (although granted, it would need to be on something smaller than VW). I am surprised too, but who knows - maybe someone somewhere has just updated their bag of tricks.

Does any reader know what happens if you have borrowed shares to short and *can't* give them back?

Postscript: There's something about the commentary on the financial crisis that reminds me of sports interviews; firstly, the lack of content and repetition of cliches, secondly the use of language:

“This was supposed to be a very low-risk trade and it’s a nuclear bomb which has gone off in people’s faces,” said one hedge fund manager.

If it's a nuclear bomb it doesn't need to go off in your face, and if it goes off in your face it doesn't have to be nuclear.

The normal distribution

This beautiful image comes courtesy of W. J. Youden.

This beautiful image comes courtesy of W. J. Youden.

I've been reading Edward Tufte's superb The Visual Display of Quantitative Information - perhaps the most perfect book I've ever come across. Almost every page is a revelation, so expect me to be posting more of the wonderful graphs Tufte has collected in the future.

Friday Special 77

Schadenfreude

KATMANDU, Nepal (AP) — The chief of the state-owned utility company said Thursday that former King Gyanendra and his relatives will be forced to pay outstanding electricity bills totaling more than $1 million.

Gyanendra and his relatives have not paid the state-owned Nepal Electricity Authority since he seized absolute power in 2005.

Arjun Karki, chief of the company, said 22 buildings and compounds are covered by the bills. Many are private residences of the ex-king and homes belonging to his daughter, sisters and cousins. Some of the buildings on the list, like the royal palaces, have since been nationalized by the government.

The company has given a 15-day deadline for the bills to be paid, Karki said. If they remain unpaid, the electricity will be cut off, he said.

The UFO files

Page 172: Claim in a newspaper article that ‘a man from the government’

visited two young girls in Leeds who reported seeing a UFO landing.

Page 173: Cutting from the Sunday Mirror 17 May 1987 quoting the Admiral Lord Peter Hill-Norton, a former Chief of Defence Staff, who had become a UFO believer on retirement from the MoD.

Pages 189 - 202: This section of the file contains a full copy of BUFORA’s 1986 publication Mystery of the Circles, a pamphlet co-authored by Jenny Randles and Paul Fuller on the crop circle mystery.

Page 214: In May 1985 Ralph Noyes wrote to his successor as head of DS8 (which became Sec(AS) in 1985) asking if MoD had retained copies of “interesting gun-camera clips” taken by RAF aircrew during the 1950s that “suggested the existence of a puzzling phenomenon.”

This is from the Highlights Guide to The UFO files just released to the National Archives by the Ministry of Defence, containing reported sightings of UFOs from 1986-1992.

Read all about the near collision of a passenger jet and UFO in Kent and the pilots of a US Air Force jet being ordered to shoot down a UFO over East Anglia, and make sure you wander through the rest of the excellent National Archives website. Who knows, maybe you end up with a PhD in economic history.

I like it when you talk dirty

I have always thought that the issue of the relationship between financial markets and the "real economy" was really deep. I thought that it was a critical part of macroeconomic theory that was poorly developed. But the economics profession for the past thirty years instead focused on producing stochastic calculus porn to satisfy young men's urge for mathematical masturbation.

This is Arnold Kling, in a very well written post.

Working paper 666

Facts about the financial crisis:

1. Interbank borrowing and lending rates have risen to unprecedented levels relative to U.S. Treasury Bills.

2. Several major financial institutions have failed.

Myths about the financial crisis:

1. Bank lending to nonfinancial corporations and individuals has declined sharply.

2. Interbank lending is essentially nonexistent.

3. Commercial paper issuance by nonfinancial corporations has declined sharply and rates have risen to unprecedented levels.

4. Banks play a large role in channeling funds from savers to borrowers.

All four debunked in 2 pages of text and a collection of graphs. Required reading, ht Alex Tabarrok.

The importance of being clear

A formatting fubar involving an Excel spreadsheet has left Barclays Capital with contracts involving collapsed investment bank Lehman Brothers than it never meant to acquire.

Working to a tight deadline, a junior law associate at Cleary Gottlieb Steen & Hamilton LLP converted an Excel file into a PDF format document. The doc was to be posted on a bankruptcy court's website before a midnight purchase offer deadline on 18 September, just four hours after Barclays sent the spreadsheet to the lawyers. The Excel file contained 1,000 rows of data and 24,000 cells.

Some of these details on various trading contracts were marked as hidden because they were not intended to form part of Barclays' proposed deal. However, this "hidden" distinction was ignored during the reformatting process so that Barclays ended up offering to take on an additional 179 contracts as part of its bankruptcy buyout deal, Finextra reports.

The Register has the full story. As Merv has always warned, 'horrible things happen when you hide cells in excel'.

I see this as a manifestation of a wider lack of education on the importance of communicating information efficiently. The Spartans, Tufte, Strunk and White, the Economist, Picasso and numerous econometricians have done a lot to improve things, but management-speak, TV advertising and other such phenomena show we still have a long way to go.

Friday Special 76

Think tank of Julia Fullerton-Batten - Award winning photographer

Think tank of Julia Fullerton-Batten - Award winning photographer

What if the whole world could vote in the US Presidential election? BetaVota 2008

Paul Krugman, Nobel Laureate

I suddenly realized the remarkable extent to which the methodology of economics creates blind spots. We just don't see what we can't formalize. And the biggest blind spot of all has involved increasing returns.

That's Krugman from an essay on how he works. Here is a taste of his dark side. I also know many people who will agree that George W. Bush, apart from all his other failings, also managed to make the world a much more boring place via his effect on Krugman.

Reading The Accidental Theorist

Friday Special 75

Kill your dictator

In “Hit or Miss? The Effect of Assassinations on Institutions and War,” Olken and Jones looked at the effects of political assassination, using a strict empirical methodology that takes into account economic conditions at the time of the killing and what Olken calls a “novel data set” of assassination attempts, successful and unsuccessful, between 1875 and 2004.

Olken and Jones discovered that a country was “more likely to see democratization following the assassination of an autocratic leader,” but found no substantial “effect following assassinations—or assassination attempts—on democratic leaders.” They concluded that “on average, successful assassinations of autocrats produce sustained moves toward democracy.”

From a profile of Ben Olken in the American. And here's the paper (free access).

Video of the day

Lehman's Richard Fuld makes the case for a long-dated compensation system.

Addendum: And this, ladies and gentlemen, is what passes for journalism.

Friday Special 74

I.O.U.S.A. One Nation. Under Stress. In Debt.

Google Maps now features train schedules

Mastering the art of photography

Stata lessons & other resources

A friend asked for a quick list, so here goes:

UCLA's excellent resources to help you learn and use Stata

Another great collection of Stata Resources by Park Hun Myoung, as well as a stata command cheat-card

London School of Economics Stata Resources

Syracuse University's Stata tutorial

Program in Statistics and Methodology by the pol sci's at Ohio State University

Duke Stata tutorials

Social capital formation in rats

[...] we show experimentally that cooperative behavior of female rats is influenced by prior receipt of help, irrespective of the identity of the partner. Rats that were trained in an instrumental cooperative task (pulling a stick in order to produce food for a partner) pulled more often for an unknown partner after they were helped than if they had not received help before.

The paper, published in PLoS Biology, is free to access. With the exception of direct reciprocity (the 'you've been nice to me, I'll be nice to you' type), no other mechanism for reciprocity had ever been demonstrated in nonhuman animals before.

'Altruistic behavior by previous social experience irrespective of partner identity' is fundamental to human society, and perhaps the single behaviour economic theory most struggles with.

Obama meets Bartlet

Here.

Bailout tidbits

In case you missed it, Friday saw a hell of a meeting:

The intense discussions reportedly saw US Treasury Secretary Henry Paulson literally down on one knee, begging Ms Pelosi to help push through the bail-out package.

It looks like economists may have had something to do with the plan bein' stalled and all:

Republican Senator Richard Shelby moments ago on CNN explaining why the tentative deal reached earlier today is bunk:

"If 200 of our economists say the plan is flawed we should listen to them."

Here's the statement by the actually 192 economists.

And last but not least, Greg Mankiw's smart friend discovers a free lunch - go no further than point 1.

Friday Special 73

Photos That Changed The World (explicit picture warning)

Photos That Changed The World (explicit picture warning)

Twelve canoes: We are the first people of our lands.

You couldn't ski to save yourself - perfect for a Friday lunch break

Why $700 billion?

I was wondering about that. Zubin Jelveh has the answer:

[...] There are roughly $14 trillion in outstanding residential and commercial mortgages and five percent is also roughly the loss rate on those categories, he added. Five percent of $14 trillion is = $700 billion.

Nice.

"It's not science," Bernanke said.

Wronging rights

Kate has a B.A. in Genocide from NYU's Gallatin School. Amanda has a Masters Degree in Violence, Conflict, and Development Studies from SOAS at the University of London.

These girls have some seriously wicked education, and they author the highly recommended wronging rights blog. Their special skills: crimes against humanity, modern warfare, and the social construction of atrocity. It's a delight to read.

Postscript: As a bonus, the top post right now comments on yet another horrid BBC news story - and as loyal readers of this blog know, I NEVER get tired of stories pointing out how abysmally bad the BBC is and imply I should be getting my license fee back.

Losing money to avoid the risk of losing money

There are two main reasons people don't want government interfering in private markets:

1. The rule of law. No-one can be referee and player at the same time, and government officials should not be allowed to use their discretion to benefit one player over another.

With the Paulson plan, not only will there be discretionary action on a vast scale, but it also looks like there will be a minimal degree of accountability. This is not specific to the current plan however: any 'solution to the crisis' requires discretionary, arbitrary actions by the Treasury and Fed.

2. Government is inefficient. It is likely to make a mess of things and waste taxpayer money, so if something can be handled by the private sector it should be.

What I find funny with the Paulson plan is that instead of doing something to address this worry, it actually guarantees that taxpayers' money will be wasted. The fund is limited to buying worthless securities, so it doesn't even allow the possibility the taxpayer might turn a profit or even minimise the loss. It boils down to preferring to lose money instead of running a risk of losing money.

And what makes this even more remarkable is that the current environment is the best possible for government to actually make money by investing in financial markets. Following standard commentary, the biggest problem right now is not that there are gigantic losses in the system, but rather a lack of liquidity and a lack of trust. Government is the unique institution right now that enjoys an abundance of both, and in any economic system whoever controls the scarce resource is amply rewarded.

A plan along those lines, albeit one which I think could be improved, is described here. The Economist blogger's reaction is telling:

I get the feeling that a bigger hurdle to the latter plan than any real concern would be a gut Congressional reaction against the government taking equity stakes in a broad array of American corporations.

The Zingales plan also has much to recommend it, although it wouldn't be my first best option.

For my take on the long-term solution to the problems in the finance industry, tune in later this week.

Many (other) serious people think the Paulson plan sucks: see Naked Capitalism, Politico, and of course Tyler Cowen and Greg Mankiw.

3 year old saves mother's life

Incredible:

A three-year-old boy came to his mother's rescue by dialling 999 after she had an epileptic fit.

Jack Thomson called the emergency services from his mum's mobile phone. When the line went dead he found another phone and dialled again.

Here's the video report.

Quis custodiet ipsos custodes?

It is enough to say that for 6 of the last 13 years, the Secretary of Treasury was a Goldman Sachs alumnus. But, as financial experts, this silence is also our responsibility. Just as it is difficult to find a doctor willing to testify against another doctor in a malpractice suit, no matter how egregious the case, finance experts in both political parties are too friendly to the industry they study and work in.

This is from the the truly excellent 2-page essay by Luigi Zingales on why the Paulson plan sucks. He is right: no matter how easily you can switch your hats around, you may find it difficult to be harsh to the people and companies you spent your career with. Did Margaret Thatcher hail from a long line of coal-miners?

Manchester United's new shirt

Old Manchester United shirt: New Manchester United shirt, to reflect change of sponsor:

New Manchester United shirt, to reflect change of sponsor:

And from the same loyal reader, I have no idea if this is true but it still is hillarious:

Bloomberg reports that Lehman's Brothers' Canary Wharf landlord prudently insured the firm's rent in case Lehman ever had difficulty paying up. It looked dodgy there for a moment, though, as the policy was taken out with AIG...

A day at the stock exchange

Friday Special 72

Goog-411: Another attempt to making our lives easier

Houses cost more in the summer

Tim Harford explains why.

The destruction that Lehman wrought

Empires came crumbling down, blood flowed on the trading floors and the real economy quickly headed for the Great Depression mark II. The collapse of Lehman Brothers led to a true Black Week, as predicted by numerous self-serving bankers.

Only it didn't.

The Dow fell from 11260 four days ago to 11060 yesterday - that's 200 points, or 1.8%. When future dictionaries define 'disaster', they will not be displaying this picture by means of example: (Source: Yahoo finance)

(Source: Yahoo finance)

Now, the worse is not necessarily over, and markets might yet crash as a direct result of this week's events. There is still a not-so-reassuringly-low probability this blogger will have to eat his words in the not so distant future. But so far it looks like Lehman's demise caused no more than a shrug.

It really is impressive how quickly the lessons of Bear Stearns were not only understood but also put to action by the bankers (be sinister and wait long enough, and the Treasury will give you a bank for free.) Yet, it is even more impressive how the government put an end to the emerging orthodoxy.

A proud week for everyone fighting on the taxpayer's side. Public officials, I salute you!

Best argument for creationism, ever

No, not this one. This reminds me too much of celestial teapots and the fact that a strong prior will get you anywhere (and you can't have science without priors). Thucydides would have been appalled by this sophistry. I'm talking about this one:

The materialist explanation of the creation has nothing to offer - if we came from nothing and go into nothing, then that encourages people to lead reckless and materialistic lifestyles.

Evolution is a world-view that leads to futility. It's no wonder people are dissatisfied with it.

We have no reason to accept knowledge that disatisfies us. You should believe what pleases you.

Just don't try this with gravity.

What happens when we die?

A number of recent scientific studies carried out by independent researchers have demonstrated that 10-20 per cent of people who go through cardiac arrest and clinical death report lucid, well structured thought processes, reasoning, memories and sometimes detailed recall of events during their encounter with death.

Here is more on the World's Largest-Ever Study of Near Death Experiences. This is interesting stuff:

“Contrary to popular perception,” Dr Parnia explains, “death is not a specific moment. It is a process that begins when the heart stops beating, the lungs stop working and the brain ceases functioning – a medical condition termed cardiac arrest, which from a biological viewpoint is synonymous with clinical death.

“During a cardiac arrest, all three criteria of death are present. There then follows a period of time, which may last from a few seconds to an hour or more, in which emergency medical efforts may succeed in restarting the heart and reversing the dying process. What people experience during this period of cardiac arrest provides a unique window of understanding into what we are all likely to experience during the dying process.”

During the AWARE study, doctors will use sophisticated technology to study the brain and consciousness during cardiac arrest. At the same time, they will test the validity of out of body experiences and claims of being able to ‘see’ and ‘hear’ during cardiac arrest.

Dealing with fanmail

Science fiction master Robert Heinlein engineered his own nerdy solution to a problem common to famous authors: how to deal with fan mail.

In the days before the internet, Heinlein's solution was fabulous. He created a one page FAQ answer sheet -- minus the questions. Then he, or rather his wife Ginny, checked off the appropriate answer and mailed it back. While getting a form letter back might be thought rude, it was much better than being ignored, and besides, the other questions you did not ask were also answered!

From CT2, via Statistical Modeling. The actual letter is brilliant:

Inequality, poverty, or something else?

The 'human cost' of the collapse of Lehman Brothers:

Andy Bevan, 27, who works in equity derivative finance, was more upbeat.

He said he had been given the "official word" at about midday.

"It is what it is," he said. "But I am lucky - I don't have any dependants or a mortgage to worry about. I feel sorry for the managing directors - they were paid about 50% of their bonus in stock, that's been written off."

Many serious people believe that what really matters is helping people in poverty; others point out that people have preferences for the degree of inequality as well, beyond making sure the weakest in society can enjoy a certain minimum standard of living.

But this story shows there's something else at play too: being paid what is perceived 'fair', and changes in relative status. Hence our sympathy for the managing director who is losing his bonus, and our dislike of the burglar, as well as our sadness for the fallen rockstar and deposed King.

The WSJ is copying us!

Check this out, from Kids Prefer Cheese:

WSJ: "Divided Government is Best for the Market"

...since 1948, the stock market has done better under Democratic presidents (15.6%) than Republican ones (11.1%).

But it's not so simple... First, not all Democrats act like Democrats, and not all Republicans act like Republicans. John F. Kennedy, for example, was an enthusiastic supply-side tax cutter, and George H.W. Bush raised taxes. Bill Clinton promoted free trade, and Richard Nixon imposed wage and price controls.

If you assign those four presidents to the opposite party based on that -- make the two Democrats into Republicans and the two Republicans into Democrats -- the numbers completely reverse. Now stocks average 14.7% under Republicans and only 10.5% under Democrats.

In fact, it turns out that if you do just one single switch -- if you make Richard Nixon into a Democrat -- it's enough to reverse the numbers."

Loyal Bluematter. readers will of course remember that this type of analysis was pioneered here, in a seminal post investigating what more daughters do to a President.

Friday Special 71

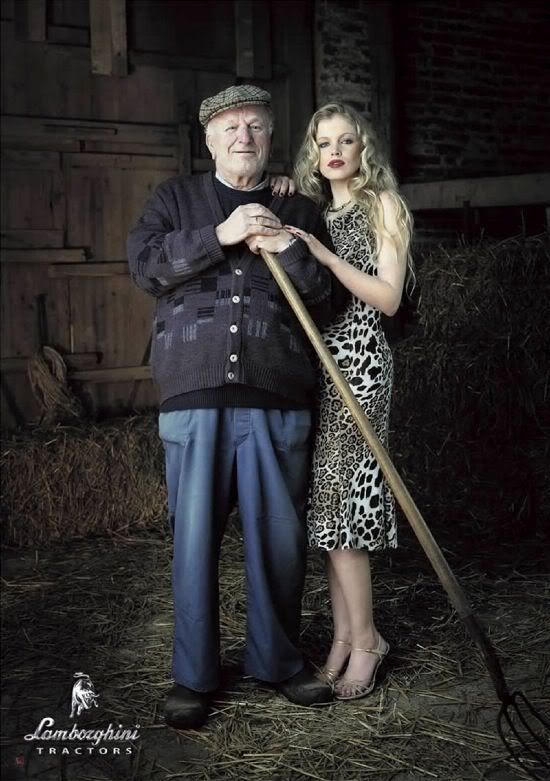

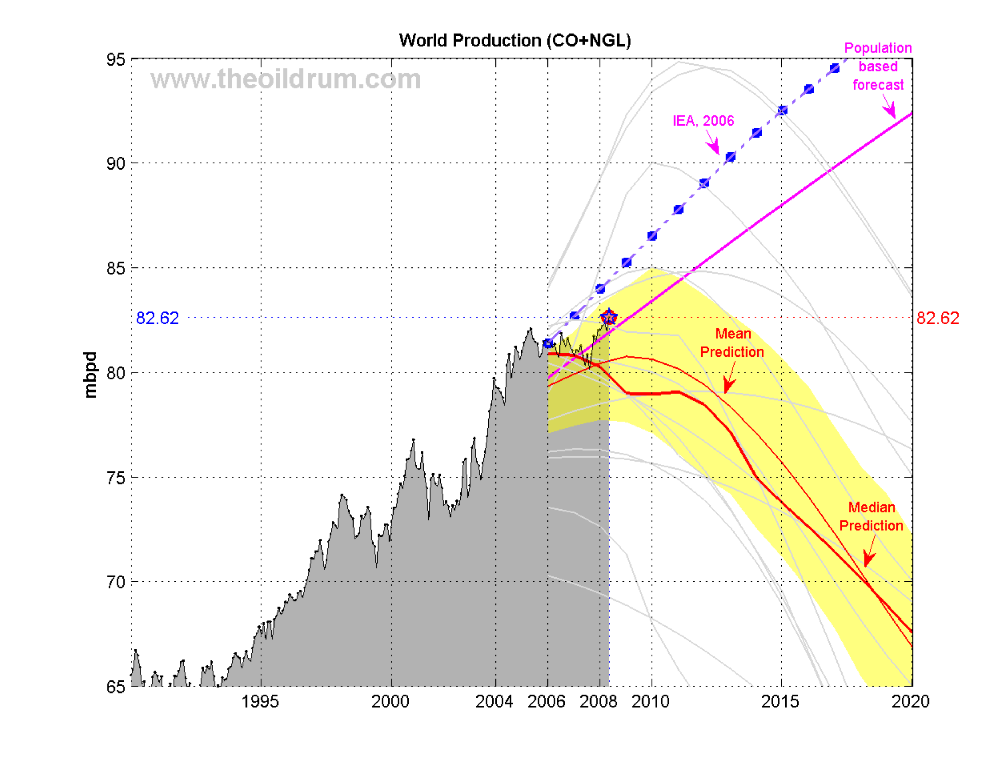

World oil production forecasts

World oil production forecasts

The highly effective search egnine SearchMe is most likely the best you have ever used

REI travel adventure is to desire, to experience, to seize

A thought that has been on our minds this week

On the art of street illusion

Play with the spider

On externalities and Pigouvian taxation

The issue

Most people don't know how to deal with an externality, and don't understand the purpose of Pigouvian (not Pigovian - see footnote) taxes. 'Most people' is more likely than not to include you too.

Shock value

The extent to which people change their actions as a result of pigouvian taxation is irrelevant. So, a pigouvian tax on carbon emmissions is the best response to global warming, even if it does not lead to any reductions in carbon emissions.

The snappy part

An externality is generated when I do not take into account the full social costs of my actions when making decisions. In other words, I do something I like which you don't, but because I don't care about your feelings I end up doing it too much.

For an externality to create problems, two things must be going on:

a. no clearly established property rights (am I entitled to polluting or are you entitled to a clean environment?)

b. trade between the holder of the property rights and the non-holder is not possible (i.e. I can't compensate you to allow me to pollute if you are entitled to a clean environment, or you can't pay me to not pollute if I am entitled to pollute).

Let's stick with carbon emmissions. Property rights are well established: they are held by governments, and they can choose to represent the rights of all people of the world, the fauna and the flora of the world and generations yet unborn as they see fit. So no problems there.

The means to trade are also present: enter pigouvian taxation.

Now, most people think that a pigouvian tax ought to be imposed to reduce pollution, full stop. If the pigouvian tax has only a small effect on carbon emmisions, the thinking goes, then the pigouvian tax has 'failed' and other measures ought to be taken, namely non-price restrictions (e.g. banning carbon emmissions above a certain level, restricting the supply of oil, etc).

This is wrong. The degree to which the production of carbon emmissions changes is irrelevant. As long as your pigouvian tax equates the private to the social costs, you are in the best possible world. If you don't agree, then your problem lies with the initial allocation of property rights or with the distribution of the pigouvian tax revenue or with democracy itself, not with correcting for the externality in the world in which we live in.

The only 'problem' stemming from an 'uncorrected' externality is inefficiency, and the best way to deal with that inefficiency is to apply an appropriate pigouvian tax. Any perceived problems beyond inefficiency should not be addressed in the context of 'correcting' the externality.

Illustrative example - post starts getting boring from here onwards

I like driving my car around your garden. You like your garden to be car-free. I produce an externality in that my private actions affect your welfare.

Possibility A: You own the garden. If driving my car is worth more to me than having a car-free garden is worth to you, I can pay you so that you let me drive in your garden. If not, I don't pay you and you have a car-free garden. That's Pareto efficiency; you can't make anyone better off without making someone worse off.

Possibility B: I own the garden. If driving my car is worth less to me than having a car-free garden is worth to you, you can pay me so that I don't drive around. If not, you don't pay me and I keep driving around. That's Pareto efficiency again.

Now, substitute 'you tax me' for 'I pay you' and you can relate this to the rest of the post.

And if you believe that the outcome is not socially optimal, then you really have a problem with the initial allocation of property rights, not with the means by which the externality is handled. Voicing your concerns now doesn't make sense; your grievances have nothing to do with the externality we discuss here.

What you believe is that the initial allocation of wealth is wrong on grounds of fairness. The way to combat this is by moving some wealth from the garden guy to the car guy or vice versa. The tax/subsidy on car-driving is not really central to your argument.

Now you may want to skip to the footnote; for the remainder of the post I simply repeat everything I said earlier in an irritating manner

Tyler Cowen, who easily ranks amongst the top thinkers we have on social and economics issues, shocked me with this post. (One of the most powerful economists in the world also shocked me for similar reasons in a talk I attended recently, but I expected more from Tyler).

Tyler's post discusses whether it makes sense to drill in Alaska (the ANWR), and here's an excerpt:

2. There is a general global warming case against developing the resource. Note that supply restrictions can be far more effective than a Pigou tax. A Pigou tax doesn't guarantee the stuff won't be pumped anyway, albeit at lower profit.

There can be no 'general global warming case'. Fighting global warming is a means to an end, not an end in itself. I don't want a guarantee the stuff won't be pumped away, I just want those who suffer from the externality (be it non-users of fuel, Africans, wild animals or children yet to be born) to be adequately compensated by those who benefit from burning fuel. Remember the Coase theorem! The Pigouvian tax can be seen as the result of the bargaining between the different social groups with their different preferences. A crude instrument, I know, but the problems associated with establishing the optimal Pigouvian tax rate do not go away when considering non-price restrictions (and what is banning something if not an extremely large Pigouvian tax, implying an extremely large externality?).

If you are arguing against developing ANWR 'because supply restrictions can be far more effective than a Pigou tax' then why don't you also make a 'general global warming case' against developing Africa (you could use the resources to install solar panels), against reading books (you could use the resources spent reading them to pay people not to use fuel) and against living and breathing (you produce carbon emmissions)?

3. The Pigouvian case against developing ANWR makes sense only if we are taking other systematic actions to raise the price of fossil fuels and restrict fossil fuel use.

Again, the point is not to restrict fossil fuel use for its own sake, or even to raise the price because we want less consumed for the fun of it. All a Pigouvian tax has to do is equate the private with the social costs of polluting; if that is the case, whatever carbon emmissions there are at equilibrium represent the optimal amount.

Why does this misunderstanding about externalities and pigouvian taxation persists? I can only speculate. Firstly, standard textbook treatments do not bother with where the funds go (beyond stressing that, to get a neat solution, they are not to be redistributed back to the externality generators - polluters). Secondly, the sloppy ('common sense') thinking often applied requires that we should be looking to eliminate anything 'bad' such as carbon emissions, not merely restricting it to socially optimal levels.

The footnote

Pigovian is the most funny Americanism there is. You can spell labour 'labor' and behaviour 'behavior', but the guy wasn't called Pigo.

A lesson in statistics

[...] when he talks with people about statistical procedures, engineers focus on the algorithm being applied to the data, whereas statisticians are always thinking about the psychology of the person doing the analysis.

This is a big topic for another day - the day I start posting on my main area of expertise, econometrics - but these are words worth pondering.

The moral content of economic terminology in the popular press: A guide

Foreign direct investment (inbound): Good

Current account deficit: Bad

Trade deficit: Catastrophic

Capital account deficit: Not used. Presumably bad.

Weak national currency: Bad

Exports: Good

Imports: Bad

Rising house prices: Good

Falling house prices: Bad

Affordable houses: Good

Unaffordable houses: Bad

Free trade: Neutral

Unfettered free trade: Bad

Fair trade: Good

Outsourcing: Evil

Buying local produce: Divine

Pay rises: Good

Low interest rates: Good

Inflation: Bad

Communism: Very Bad

Socialism: Bad

Capitalism: Bad

Two different societies

My two home nations are very different, and it's reflected in the tax code:

In the UK, inheritance tax is applicable (at a declining rate) for transfers made up to seven years before death. Transfers of assets from a parent to the children prior to that are not taxed, and also note that there is a very significant tax-free allowance (£600,000). Nevertheless, inheritance tax raises roughly £3.5 billion a year.

In Greece, the tax on transfers of assets from parents to kids is waged at virtually the same level as inheritance tax - if that was not the case, inheritance tax would probably raise no revenue at all. In fact, a lot of families transfer assets two generations down the line (i.e. grandparents to grandchildren) to avoid paying too much tax, and they usually do so long before death (to avoid higher income tax charges).

Friday Special 70

Panoramic Snake River view in Grand Teton National Park, Wyoming

Panoramic Snake River view in Grand Teton National Park, Wyoming

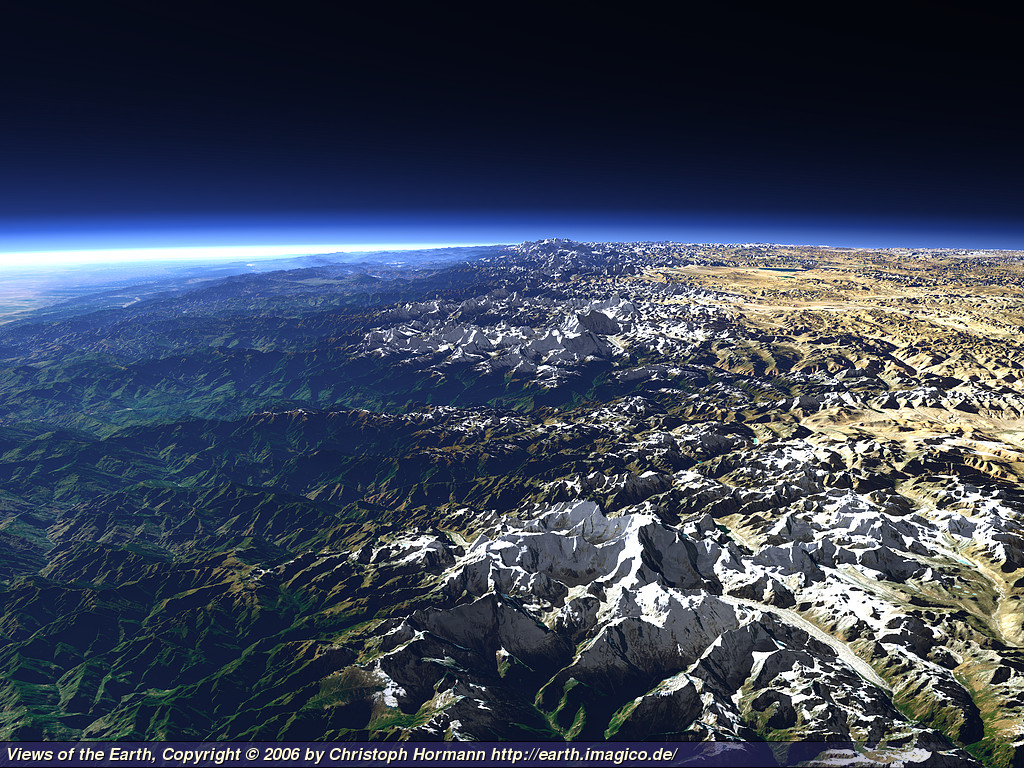

Launched today: GeoEye - to map, monitor, and measure the Earth

Seven Revolutions: What will the world look like in 2025?

Google unveils anticipated Chrome web browser

The Homer Simpson Euro

The art of the hobo nickel - carving new imagery into currency.A man in Spain recently found a Euro coin with Homer Simpson carved into what was previously the bust of Spanish King Juan Carlos. Reuters link

HT Blogadilla - (hey guys, I love your layout!). Here's more currency from the Original Hobo Nickel Society.

How reliable are GDP estimates?

Not very. The graph depicts UK data - note that the 'latest estimate' is our best estimate but, of course, by no means the true value: Thanks to Michael Blastland for putting the graph together. Here's his fifth article on the ways in which the media abuse statistics, scroll down the page for links to the other four.

Thanks to Michael Blastland for putting the graph together. Here's his fifth article on the ways in which the media abuse statistics, scroll down the page for links to the other four.

Prison and TB

Using longitudinal TB and cross-sectional multidrug-resistant TB data for 26 eastern European and central Asian countries, we examined whether and to what degree increases in incarceration account for differences in population TB and multidrug-resistant TB burdens.

We find that each percentage point increase in incarceration rates relates to an increased TB incidence of 0.34%.

Net increases in incarceration account for a 20.5% increase in TB incidence or nearly three-fifths of the average total increase in TB incidence in the countries studied from 1991 to 2002.

The paper (gated) is here.

The voice dies

Don LaFontaine passed away, at the age of 68. As a kid, I often wondered how different the world -or at least the cinema- would be without him.

He was 'the narrator guy in all the movie trailers'. Here's a great youtube clip.

Fun with statistics, "which Palin is the mother?" edition

Well, Sarah, I'm calling you a liar. And not even a good one. Trig Paxson Van Palin is not your son. He is your grandson.

The Daily Kos has an 'interesting' story claiming that Sarah Palin's youngest son, who has been diagnosed with Down's syndrome, is really her daughter's son. There is much evidence presented, mainly consisting of pictures where certain bellies appear to be too large while others too small. But statistics deliver the killer argument:

The final point of interest is that Trig Palin has been diagnosed with Down's syndrome (aka trisomy 21). This is an interesting point, as chances of having offspring with Down's Syndrome increases from under 1% to 3% after a mother reaches the age of 40. However, 80% of the cases of Down's Syndrome are in mother's (sic) under the age of 35, through sheer quantities of births in this age group.

And of course, 99% of deaths are not due to suicide, so killing yourself is safe!

Thanks to Scatterplot for the pointer.

Obama on the beach

They don't come cuter than that! For many more pictures & a family bio, check out Obama's scrapbook.

Abolition of slavery 'nail in the coffin' for poor

Angry protesters surrounded Parliament today, demanding government does not proceed with controversial legislation to completely ban slavery.

The protesters, estimated at around four million, chanted slogans against the government and demanded that the controversial measures be dropped. The protest was mainly peaceful, but there was some violence near the gates of parliament. A police spokesman said one person died following a heart attack. Twelve people have been admitted to hospital, one in critical condition, and there were sixteen arrests.

Parliament is due to vote tomorrow on the 'Make Slavery History' Bill. The date was deliberately chosen to coincide with the 48th anniversary of the vote on the historic 'Everyone is Born Free' Bill, which ended ownership of children by their parents or the parents' legal owners, and banned under-18s from entering contracts leasing themselves for a period greater than 8 hours a day.

Bluematter's political editor said that while the 'Born Free' Bill enjoyed support across the country and was welcomed by the electorate, the level of support for the current Bill is high only amongst the currently enslaved - however there is much uncertainty even around this fact, as current slaves are not allowed to vote or express their opinion in public.

'Nail in the coffin'

Government insiders told Bluematter last month that they expected only a limited reaction to the legislation, mainly from groups such as the Association of Slave Owners.

Despite this expectation, the protest today enjoyed support from across the civic spectrum, including from such unlikely allies as the Confederation of Businesses, the Confederation of Trade Unions and anti-poverty charities.

Mary Rose, the Chairperson of the CoB, said: 'How can the government expect us to compete in today's globalised economy without slaves? This will put us at a huge disadvantage, and if the legislation passes we will be challenging it at the World Trade Committee'. The CoTU has not issued a statement yet, but it is believed that their main grievance is that a sudden influx of ex-slaves in the labour rental market will significantly dampen wages.

But these were not the only grievances aired during the protest. Perhaps the most prominent theme throughout was the fight against poverty.

John Harpes, a 26-year carpenter, is one of the protesters. 'If this bill goes forward, it will be complete disaster for me' he said. 'My dream has always been to run my own business, but the bank will never lend me money without collateral. But I was born poor and the only thing I own are these two hands'.

'I will now be forced to rent my daily labour for a pittance to survive. How will I feed my children? This is the nail in the coffin for me.'

Even some slaves object the legislation. One of them said 'My master now has an interest in taking care of me, making sure I'm healthy and happy so I can produce the most for him. If I'm freed, why would he bother? I'll die in the street like a dog.'

'Back to the dark ages'

Christian groups have also been vocal in their opposition to the bill, and today a large number of believers attended the protest.

'Slavery is mentioned time and again in the Bible, and not a single verse mentions anything bad associated with the practice' said the Right Rev. John Gieves, a representative for the Inter-Christian Faith Council which speaks for all the main Christian Churches, including the Vatican and the Church of England.

'In fact, slavery is a powerful force for promoting ethical conduct and enhancing our morality, and it is a time-honoured tradition. Believers across the world will never accept this legislation.'

The Libertarian Alliance also strongly condemned the move. A spokesman said: 'The government now says that we are not even allowed to own our very own selves. They will invalidate contracts signed by consenting adults. The rights to private poverty and free exchange are inalienable, and we should not allow the nanny state to walk allover them. Abolishing slavery will return us back to the Dark Ages'

'Populist'

'These proposals are just a populist measure that will benefit a small number of those currently enslaved, but at a great cost for all generations to come', said Greg Biden, an economics professor at Harvard University and a former member of the Council of Economic Advisers.

'Not only will it remove the right to property from millions of poor people, but it will also kill entrepreneurship and innovation and will undermine the government's commitment to protect property rights in the future. The capitalist system that has allowed us to enjoy unprecedented wealth and economic growth simply cannot survive without government commiting to protect private property.'

'The future of the world is in jeopardy. Why would anyone educate themselves and invest in human capital if they cannot use it as collateral? Who will want to own an asset that he cannot sell and which he cannot commit to a given use? Which employer will invest in their staff if they can leave at any time they wish? How far can we progress economically with this unnatural restriction in place, where we are allowed to only rent out services for a very limited period of time?'

'The poor and the young, who do not own any physical capital, will suffer most. This is a tragedy in the making'

A spokesman for the Campaign to End Slavery said: 'The cost to the government of ensuring the slaves obey their masters has been spiralling out of control. Slavery is not fair on the slaves, and it is not fair on the taxpayer. Abolishing slavery is essential to protect the most vulnerable amongst us, and it will benefit the public purse. This is not a 'nanny state', this is a compassionate society.'

Miscalculation

Bluematter's political editor believes that the government may now try to defer the vote, citing a need for public consultation and more evidence on the long-run implications before the policy is introduced. Political observers believe the move has been a dramatic miscalculation on the part of the government, which hoped that freed slaves would tip the balance in its favour in the upcoming national election on January 22 but failed to predict the ferocity of the public backlash.

Parliament is expected to vote on the issue tomorrow, however the police fears that a large number of protesters will again convene outside parliament tomorrow, despite the ban on further public demonstrations.

Something you should know

Living on a farm during pregnancy may help reduce the chance of the child developing asthma, eczema and even hayfever, say scientists.

Laffer Curve: The second derivative

Recent research on President Bush's tax relief in 2001 and 2003 has found that the lower tax rates induced taxpayers to report more taxable income. In particular, the reduction in the top two tax rates induced taxpayers to report more taxable income—an increase in the size of the tax base—to such an extent that this positive behavioral response likely offset roughly 25 percent to 40 percent of the static revenue loss of lowering the top two tax rates.

HT Greg Mankiw.

Your eyes, your hands, your back

Visual artists Fernanda Viégas and Martin Wattenberg analyzed over 10,000 songs to find out which parts of the human body were mentioned the most and broke down the resulting data by genre. The result: An interactive graphic work called "Listen" that correlates musical genres with the body parts they mention the most, as part of their ongoing Fleshmap project.

As for the genre that talks about body parts the most, hip hop takes the honors with more references than any other genre. Meanwhile, gospel refers to the body the least.

I really like this, definitely worth clicking through. Here's heavy metal, as hip hop might have disturbed readers of this family blog:

Hat tip MR.

Hat tip MR.

Friday Special 69

Best moments in pictures of the Beijing Olympics 2008

Best moments in pictures of the Beijing Olympics 2008

Australia. A Baz Luhrmann Film

Could you be, the most beautiful church in the world

Informally known as Ronchamp, the chapel of Notre Dame du Haut in Ronchamp (French: Chapelle Notre-Dame-du-Haut de Ronchamp), France completed in 1954 is considered one of the finest examples of architecture by the late French/Swiss architect Le Corbusier.

Le Corbusier at first refused the commission, not wanting, he said, to be associated with a 'dead institution'.

What a poorer place the world would have been!

More pictures here, the Wikipedia entry with yet more eye-candy is here.

For economists and everyone that hates them, David Galenson takes a look at the greatest architects of the 20th century. You can find the paper at the NBER website - for some reason I can't access it right now. Find out who was the - objectively measured, naturally - greatest architect of the 20th century, the greatest building, as well as what Le Corbusier and Frank Lloyd Wright have in common with Howard Roark, the most amusingly one-sided character in all of fiction.

More Galenson here and here.

Bluematter. is back!

The reasons that kept me from the keyboard have not quite gone away, so posting will probably be slow for a while. In any case, I'm back to stay. I missed blogging.

Friday Special 68

Friday Special 67

Total Borrowings of Depository Institutions from the Federal Reserve

Total Borrowings of Depository Institutions from the Federal Reserve

Exactitudes: a contraction of exact and attitude

Friday Special 66

More on Mike, the headless chicken: Wikipedia & Website

Excellent wealth management tool

Britain seen from above

Incredible trees

Best sentence I've read today:

The Guardian described the (Russian) oligarchs as "about as popular with your average Russian as a man idly burning bundles of £50s outside an orphanage".

Friday Special 65

Can you guess where my accent is from?

It's time for some campaigning 2008

Impressive pictures from outer space

Friday Special 64

Friday Special 63

Saudi Oil: A Crude Awakening on Supply?

Saudi Oil: A Crude Awakening on Supply?

Friday Special 62

Venice by air

Venice by air

Can you identify the country Suriname in South America?

Design For The Other 90% (You are not one of them)

Amazing catch - and it's not even mayor league

100% electric: Tesla & Lightning

For sale: baby shoes, never used.

This is Ernest Hemingway's 6-word novel. Apparently, 'rumor has it that Hemingway regarded it as his greatest work'.

Here's more writers undertaking the same venture; comments are of course open if you would like to have a go.

Friday Special 61

Prison population rates globally

Prison population rates globally

Birdseye view of extraordinary creations by man and nature

Culture Crossing for international etiquette and understanding

On politicians that don't give away much

1. What's the point of staggering the release of information? The information you want out there is 'released' on day one, and there's no need or desire for more information later on.

2. The point of a presidential campaign is to reach Average Joe, not to keep the likes of Tyler and myself happy by feeding us with more news, and even more so important news. There's a simple message to be communicated - 'vote Obama cos he'll bring change' - and it will be communicated over and over again until it has reached everyone, preferably more than once. That's why companies run information-poor 30-second ads over and over again; the point is not to reach out to the afficionados, as they can no more keep a company afloat than they can win you an election.

Even more importanly, a politician that doesn't commit to specific policies (as is the case with the current low-information Obama campaign) is simply more powerful when in office, and given checks and balances and the fact that Average Joe is vehemently anti-market, anti-foreigners, anti-reason, etc, that's not necessarily a bad thing - think of how rarely referenda are used, and how the Western World would look like if that wasn't the case.

So stop complaining about politicians speaking without saying anything; on the one hand they are good marketers, and on the other they would like, once in power, to actually have some. A *successful* politician who communicates too much substance before an election can only be a populist.

Bonus: This comment on Tyler's post is worth perusing:

Obama is too intelligent and well educated to have any fixed principles. He has fixed inclinations and preferences, but not principles.

Waste not, want not

The time seemed perfect—perhaps even overdue!—for a bra that could harness the untapped power of breast motion. [..] Maybe it's not very sexy to see breasts as a pair of batteries, but oil prices are so high, people are jogging to work.

Slate is after a breast-powered ipod.

Friday Special 60

Dude - One word, so many meanings!

FiveThirghtyEight: Electoral projections done right

Baby duck feeding giant Koi carp in Japan

Do you need a coffee break?