Friday Special 43

Out of a viral ad campaign of Colleges Ontario

8 months to go... Who would the world elect?

Nature at its best in this panoramic collection

Can you tell whether Chinese, Japanese or Korean?

(Username & password: bluematter)

Top 10 New York architecture

You've got yourselves an identification problem

PRESIDENT BUSH AND SENATOR KERRY BOTH WENT TO YALE, AND BOTH WERE MEMBERS OF SKULL AND BONES. IS AMERICAN POLITICS BECOMING MORE ELITIST?

No. Skull and Bones is becoming less elitist.

This is William Buckley, who died two days ago. This was his sin.

The central question that emerges--and it is not a parliamentary question or a question that is answered by meerely consulting a catalog of the rights of American citizens, born Equal--is whether the White community in the South is entitled to take such measures as are necessary to prevail, politically and culturally, in areas in which it does not predominate numerically? The sobering answer is Yes--the White community is so entitled because, for the time being, it is the advanced ace. It is not easy, and it is unpleasant, to adduce statistics evidencing the median cultural superiority of White over Negro: but it is fact that obtrudes, one that cannot be hidden by ever-so-busy egalitarians and anthropologists.

The Paradox of Happiness

Economists tend to bang on about how great economic growth is- the theory being that as income rises everyone gets more stuff and everyone gets happier. But a new branch of economic research is challenging the primacy of growth (the research is so fresh and new, even Call me Dave is getting involved)

The "Paradox of Happiness" is a succinct expression of this challenge. The Paradox says that within a country at a point in time happiness varies directly with income, but over time happiness does not increase as a country’s income increases. Put another way, people are happier being at the top of the income distribution, but as everyone in the distribution gets richer, no one gets appreciably happier (NB this result only applies to developed countries, developing countries behave differently).

The table below shows how people at the top of the distribution are happier than people at the bottom of the distribution. It also shows % of people in each happiness band stays relatively constant across generations, despite growth.

How happy are the Rich and the Poor? (USA Gallup poll data)

| | Top quartile (The Rich) | Bottom quartile (The Poor) | ||

| | 1975 | 1998 | 1975 | 1998 |

| % Very happy | 39 | 37 | 19 | 16 |

| % Quite happy | 53 | 57 | 51 | 53 |

| % Not too happy | 8 | 6 | 30 | 31 |

Two things explain the Paradox. Firstly, recalling my last post, I argued we are an envious bunch- every pound you earn makes me worse off, you wicked swine. So whilst we all get richer, we all get miserable at each other's wealth- offsetting the benefits of higher growth. Whilst the amount of material goods we can produce is potentially huge, the actual good that creates happiness is status- which is in fixed supply (only one dog can be the top dog, so if its being top dog that makes people happy, we have a problem)

Secondly, something called habituation. Habituation is the process through which individuals adapt to new situations by changing their expectations. This adaptation implies that higher incomes are accompanied by rising expectations, such that higher incomes lead to only temporary or small increases in well-being. The evidence for this process is widespread. For example, Clark (1999) finds that job satisfaction in the

Taken together, income rivalry and habituation can explain why economic growth is not increasing the proportion of people who report themselves to be very happy. These phenomena represent powerful challenges to economic orthodoxy.

Neoclassic stalwarts will complain:

i) you can't measure an individual's happiness

ii) you can't compare people's happiness (inter-personal comparisons are impossible)

iii) happiness economics sounds like something studied by sociologists, and sociologists should be ignored

I leave my response to the Neoclassic critique to a later post (you lucky things).

Why do you want to be Rich?

Imagine I offer you the choice between living in one of two worlds, A or B:

A: you earn £50k, and others earn £25k

B: you earn £100k, and others earn £250k

In which world would you prefer to live?

I'm guessing that many of you will have chosen world A (or at least been very tempted to do so), despite the fact that you get 50% less cash than in world B. Indeed when Solnick and Hemenway (1998) first conducted this test with a group of Harvard graduates they found that half of respondents chose World A. (Read summary here)

What does this survey tell us? Well, it implies something that it is fairly obvious but which economist's seldom incorporate into their models: what people really care about is their income relative to other people's, rather than their absolute level of income per se.

The way in which we are envious of other people's income has begun to be more systematically examined. For example Blanchflower and Oswald (2004) use a large panel data set to estimate the impact of other people's income on an individual's self-reported happiness. They find that the negative effect on happiness of other people's income is about 30% of the positive effect of own income. That is, if your neighbour earns an extra £1, this event decreases your happiness by the same extent as a fall in your own income of 30p.

So to answer the question posed as the title of this Blog entry- my hypothesis is that a big part of the reason you want to be rich is not because you want to enjoy consuming goods in and of themselves (as standard economic theory suggests), but because you want to have more stuff than your mates- so you can parade around feeling like the big man.

As J.S Mill once wrote: Men do not desire to be rich, but to be richer than other men

Letter from Turkey

Turkey is preparing to publish a document that represents a revolutionary reinterpretation of Islam - and a controversial and radical modernisation of the religion.

The country's powerful Department of Religious Affairs has commissioned a team of theologians at Ankara University to carry out a fundamental revision of the Hadith, the second most sacred text in Islam after the Koran.

The Turkish state has come to see the Hadith as having an often negative influence on a society it is in a hurry to modernise, and believes it responsible for obscuring the original values of Islam.

Its supporters say the spirit of logic and reason inherent in Islam at its foundation 1,400 years ago are being rediscovered. Some believe it could represent the beginning of a reformation in the religion.

According to Fadi Hakura, an expert on Turkey from Chatham House in London, Turkey is doing nothing less than recreating Islam - changing it from a religion whose rules must be obeyed, to one designed to serve the needs of people in a modern secular democracy.

Significantly, the "Ankara School" of theologians working on the new Hadith have been using Western critical techniques and philosophy.

It's a very interesting development. The Enlightenment did not kill Christianity, but it softened it up and increased its separation from politics.

And as anyone who has looked at religion carefully knows, the tails are affected by the mid-region of the distribution.

Another mystery guest-blogger

Look out, he should be making his appearance soon.

And no, datacharmer is not authoring the Friday Special.

Stranger than fiction

What a beautiful film. In the best tradition of American movie-making, the story is incredibly good and the casting inspired. It even gets brownie points for being chick-friendly.

Quantifying rationality

Administer a time-bound maths test to subject A, taking care to explain what the notation means ,etc.

If subject A fails to get a 100%, you can safely conclude subject A is not Homo Economicus. Subject A is acting irrationally.

You can now quantify the degree of rationality. Subject A getting 60% in a test covering the math of optimal asset allocation directly maps to Subject A being 60% rational when it comes to asset allocation decisions.

Friday Special 42

Audi and the R8 are here. Here's a closeup

Audi and the R8 are here. Here's a closeup

Reflecting upon the explosive growth of Dubai

A riddle from the east, enhanced with Flash animations

Chat with friends while surfing: Meebo plugin for Firefox

Planning an informed jump off a bridge

Zubin Jelveh has the inside scoop on where to go to avoid the crowds:

How to leave your wife

I can see few material differences between breaking up and colonoscopy.

I can see few material differences between breaking up and colonoscopy.

Make up your mind as to whether you want your ex-partner to escape lightly or suffer deeply. Then apply pattern B or pattern A respectively.

The picture is from Daniel Kahneman's Nobel prize lecture. I suspect a similar principle applies to spending time with your kids.

Efficiency gains vs. government contacts in China

We document the market response to an unexpected announcement of proposed sales of government-owned shares in China. In contrast to the "privatization premium" found in earlier work, we find a negative effect of government ownership on returns at the announcement date and a symmetric positive effect in response to the announced cancellation of the government sell-off [Empasis DC]. [...] the positive effects on profits of political ties through government ownership outweigh the potential efficiency costs of government shareholdings.

Companies with former government officials in management have positive abnormal returns, suggesting that personal ties can substitute for the benefits of government ownership. The "privatization discount" is higher for firms located in Special Economic Zones, where local government discretionary authority is highest.

From a new NBER paper describing what happens when the 'grabbing' and 'helping' hands of the Chinese state meet the invisible hand of the market.

Friday Special 41

Stage your electoral Face Off between your favorite candidates with Select2008

Stage your electoral Face Off between your favorite candidates with Select2008

Beautiful panoramic view of San Francisco in a full day time lapse

Video coverage of Bill Gates' last day at work

Bush, the debt, Mankiw and spin

An 'econonerd friend' of Greg Mankiw's in the White House emails him with this analysis. Greg posts it approvingly, and I am fuming. Yes, Senator Conrad's analysis is misleading, but he is a politician - I've long learned to not seek insightful economic analyses in public statements by that lot. Last time I checked, however, Greg Mankiw was still one of the brightest stars of the economics profession and higher standards apply.

Let the econonerd speak:

Yes, the federal debt is higher than when the President took office. Debt in 2001 = 35.1% of GDP. Projected debt in 2009 = 37.9% of GDP. [...] Measured as a share of the economy, it's about 8% higher than it was when the President took office. (37.9 - 35.1) / 35.1 = 8%

Debt as a % of GDP stood at 35.1 at the end of fiscal 2000. But, as Senator Conrad reminds us, the budget is presented by the president outgoing, so GW Bush did not inherit the debt at 35.1% of GDP: he inherited it at 33% of GDP, where it stood at the end of fiscal 2001. (37.9-33)/33 = 15%.

So how did G.W. do compared to his predecessors? I multiply 15% by 8/7 to estimate an overall effect of Bush on the debt, as well as double the number for Presidents who only served one term (so that I can compare like with like). 'Kennedy' covers both the Kennedy and Johnson presidencies, and 'Nixon' covers Ford's presidency too.

Here's the effect each administration had on public debt as percentage of GDP:

George W. is slightly better than his dad in terms of not-increasing-public-debt-by-very-much, and he shines compared to Reagan. Eisenhower and Nixon/Ford actually reduced debt as a % of GDP (albeit by less than the adjacent Kennedy/Johnson and Carter administrations respectively), while Bill Clinton can boast the largest reduction since at least Kennedy/Johnson.

So, historically speaking, W. Bush only performs 'well' compared to the worst performers, Reagan and his dad, both Republicans (note that all Democrat Presidents achieved significant reductions in debt as % of GDP during their terms)

And there's more:

[Chairman Conrad's presentation is misleading in that it includes] no comparison to the historic average - It's relevant to compare our federal debt [held by the public] with historic averages, to see if we're in a lot of debt relative to where we've been in the past.

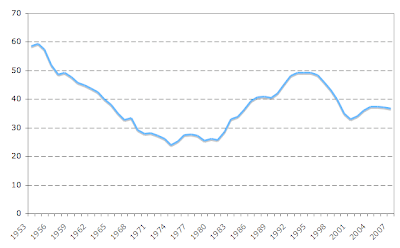

Here's the graph the 'econonerd' - (by this stage I believe a more accurate description would be econospinster') posts:

And here is the same series going further back:

'Debt is near the historic average'?!? The series goes all-over the place, so 'historic averages' are mostly driven by the time window chosen. Choose the number of years that suits you, and you can claim that current debt as a % percentage of GDP is higher/lower/equal to the long-run average (going back beyond 1953 makes this even more interesting). Why not calculate a historic average going back 30 years? (the decision to not go back further than 40 years probably has to do with the fact people would start thinking WWII). The econonerd also missed the killer point here: why not compare US Federal debt with Italian public debt? (do I have to do your work for you?)

Also, note that choosing to start your graph at 1991 creates a nice 'debt ain't that high' visual effect. (the first person to propose a plausible-sounding reason why 1991 should be the choice of a starting point for a 'debt under Bush' graph wins a White House 'economics' job).

And finally, a question for Bluematter. readers: Is "almost doubling" an inaccurate description of a 79% increase? This is not a trick question, looking forward to your views in the comments section.

Update: Andrew Samwick has another objection, via Angry Bear.

Econometric causality

James Heckman has an excellent paper on the subject (free access).

Protectionism in everything

And at this rate, for ever:

Since the 1200s, South Shields has the right to block rival markets being run less than a day's donkey ride, or six and two-thirds of a mile, away.

North Shields, on the opposite side of the River Tyne, wants its own market, but is blocked by the ancient charter.

"We have been trying for a number of years to get around this, but every time we have approached South Tyneside Council, they say they were given a market charter some time in the 1200 region by King John, so that no one can set up a market within a day's donkey ride."

A spokeswoman for South Tyneside Council said that the ancient six and two-thirds mile exclusion zone referred to the distance a trader was deemed to be able to travel from home, sell for eight hours, then return in a single day.

She added: "South Shields market is [...] of great importance to South Tyneside and, as its owner, the council has a duty to protect it from rivals."

Friday Special 40

Best pictures of 2007 MSNBC, but not for the faint-hearted

Best pictures of 2007 MSNBC, but not for the faint-hearted

Serendipity: 10 accidental inventions

Create a new face from portions

1,000 travel recommendations

Bored at work?

When Barry met Robert

A couple of days ago, a friend had a 'priceless' moment with one of the world's most celebrated economists. Since anonymity prevents me from divulging any more details, here is a hillarious account of a very similar incident when Barry Ritholtz met Robert Engle. (I emailed the post to my friend and it made him feel a lot better - thanks Barry).

The moral of the story? Always check whether the person you are talking to happens to have been awarded a Nobel Prize.

Anger over £1.99 Tesco chickens

I kid you not. (note to non-UK readers: Tesco's is the biggest and most successful supermarket chain in Britain) This is the story and where the debate is at:

Animal welfare and farming groups have criticised the supermarket giant Tesco for cutting the retail price of its standard whole chicken to £1.99.

The store says bringing down the price of a bird from £3.30 will benefit "shoppers on a budget".

The National Farmers' Union (NFU) says the move is "extremely ill-judged and short sighted. [...] They're devaluing the product and doing it at a time when, overall, the market is strengthening and chicken prices are rising[DC: Wtf?!?]. They're sucking value out of the supply chain and unless Tesco is going to subsidise this, it is not a sustainable price," he said.

Compassion in World Farming (CIWF), which praised the chain in its latest supermarket survey for improving the environment for indoor-reared birds, believes that Tesco have taken the wrong approach [...] "If Tesco is prepared to drop their prices in this way, why don't they decrease it on the higher welfare chickens and make that more accessible to poorer consumers."

The RSPCA, which oversees the "Freedom Food" programme for livestock welfare, said low-price chicken "was not the answer".

Once more, the BBC's coverage of all matters economic is abysmal (not that political coverage is much better - Chris Dillow makes some very good points here). This is decidedly not public service broadcasting; I want my license fee back.

Related: Indiffirence Merv on hating supermarkets.

The Diving Bell and the Butterfly

A well written and well made movie, based on an extraordinary true story:

At the age of 43, on December 8, 1995, Bauby, editor of ELLE magazine, suffered a stroke. When he woke up twenty days later, he found he was almost entirely speechless; he could only move his mouth a little, grunt, and blink his left eyelid.

Despite his condition, he authored the book The Diving Bell and the Butterfly by blinking when the correct letter was reached by a person slowly reciting the alphabet over and over again. Bauby had to compose and edit the book entirely in his head, and convey it one letter at a time.

The movie reminded me of Mar Adentro, another true story, as well as the classic Johnny Got his Gun (and read the book, even if you disagree with it's politics. You can buy it for a pound here.)

And it might say something about me, but the thought that kept torturing me throughout watching The Diving Bell and the Butterfly had to do with the communication system devised by Bauby's speech therapist:The entire book was written by Bauby blinking his left eyelid. An amanuensis repeatedly recited a frequency-ordered alphabet (E, L, A, O, I, N, S, D ...), until Bauby blinked to choose the next letter. This made dictation more efficient. The book took about 200,000 blinks to write and each word took approximately two minutes.

Having someone recite a frequency-ordered alphabet is, of course, not efficient at all - unless your sole purpose is to minimise the number of required blinks, a minor consideration in this case.

I can think of a hundred different schemes to arrange letters so as to make the whole process of communicating letters more efficient, ranging from morse code to a mobile-phone style categorisation of letters.

Keep in mind that Bauby's ability to see, hear and think were not at all impaired, and he could easily master any such scheme very quickly.

So, a little more thinking going into this would have allowed Bauby to increase his speed of communication with the outside world and, yes, his quality of life dramatically. As simple, and as sad, as that.

Killer salt

This is startling:

[The paper] addresses the six-year disparity in life expectancy for blacks versus whites, arguing that much of the gap is due to a single factor: a higher rate of salt sensitivity among African-Americans, which leads to higher rates of cardiovascular disease, stroke and kidney disease.

Furthermore, it seems that the entire difference in salt sensitivity is the result of the transatlantic slave trade and the non-random sample of blacks that made it to America - non-random either because they were deliberately selected by the slave traders or because they were better able to survive the journey and resettlement.

The paper is here (free access), the excerpt is from a NYT profile of economics wunderkind Roland Fryer by Stephen Dubner. HT Tim Harford.

A solution to global warming too perhaps?

South Africa's parliament held a special session to debate an electricity crisis; the country has been hit by a series of blackouts since the new year.

The energy minister suggested, among some of the ways to conserve power, that people should go to bed early.

From the Economist.

Friday Special 39

Out of a selection of perfect ads

Out of a selection of perfect ads

Uncontacted tribes. This is their story.

Southeast Asia beautifully captured in photographs

The world's largest known natural crystals (up to 11 meters)

Unprecedented in history: ThePalm and TheWorld islands in Dubai